- SMSF Setup

- Assets

- Running

- SMSF Statistics from ATO

- Bank Accounts

- Macquarie Cash Management Account (CMA)

- Macquarie Online Trading

- Add a new Member to the SMSF

- Becoming an SMSF Trustee

- Preservation Age

- SMSF Accounting Melbourne

- Expenses in an SMSF

- Insurance

- Estate Planning

- Winding up an SMSF

- Transfer Benefits in Superannuation

- Actuarial Certificate SMSF

- SuperContributions Tax Increase on High Income

- Corporate Trustee Address Change

- Splitting with your Spouse

- Year end Requirements

- Packages for SimpleFund 360

- Contributions

- SMSF Pensions Phase

- SMSF Audit

- About Us

- SMSF News

- Home

- SMSF Audit

- Engage Us

Engage Us

If we are your accountant, we will arrange for your SMSF audit, and the fees for performing the annual audit is included in your monthly SMSF fees. Do not read any further. You are covered.

If you prepare your own SMSF accounts and tax return, we can perform your audit. We also perform the audit function for other accounting and financial planning firms.

Engage us

Contact us by emails to engage Superannuation Warehouse to perform your SMSF audits. We will send you a secure internet location to upload audit files. The main components are permanent files, previous year accounting and tax records and current year Financial Statements and audit support.

Please feel free to access the links below to download the Engagement Letter and Trustee Representation Letter. We kindly request that you review the documents carefully, provide the necessary information and proceed to sign them.

To ensure a seamless and efficient audit process, we have prepared comprehensive Audit checklists. These checklists will guide you in assembling and organising the required audit files before sending them to our team.

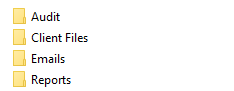

Please arrange your files in folder similar to this format and this can then directly be uploaded to us:

Permanent files

The permanent section of an SMSF should consist of the following:

Previous year files

The previous year files are important as we will load check the opening balances to ensure all assets are carried over to the current financial year. Files should consist of:

- Financial statements with notes

- Tax return

- Audit report

Q&A (click on the question to reveal the answer)

A: An approved auditor should be appointed at least 45 days before the due date of your Fund’s tax return lodgement. For more information on this, please click on this link.

Have Questions?

Ask Superannuation Warehouse experts

Your Peace of Mind

Superannuation Warehouse is based in Melbourne and have clients throughout Australia. We deliver our SMSF administration services in an efficient and paperless way. This efficient service means a competitive fee to you. Our low ongoing fees will enable you to take control of your Super.

General Advice

Superannuation Warehouse is an accounting firm and do not provide financial advice. All information provided has been prepared without taking into account any of the Trustees’ objectives, financial situation or needs. Because of that, Trustees are advised to consider their own circumstances before engaging our services.